maine excise tax exemption

Property owners would receive an exemption of 25000. Excise Tax is defined by State Statute as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways.

Maine Sales Tax Small Business Guide Truic

In 2019 Maine passed bill LD 1430 which introduces a solar tax exemption for both business and residential owners enabling renewable energy adopters to save moneywhile adding real value to their property and assets.

. Excise Tax is defined by State Statute as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways. 691 - 700-B Homestead 36 MRS. To qualify for this exemption the resident must present to the municipal excise tax collector certification from the commander of the residents post station or base or from the commanders.

681 - 689 Snowgrooming Equipment 36 MRS. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. The following exemptions qualify for reimbursement.

Except for a few statutory exemptions all vehicles registered in the State of Maine are subject to the excise tax. What is Excise Tax Excise Tax is an annual tax that must be paid when you are registering a vehicle. 6561J Business Equipment Tax Exemption 36 MRS.

Sales Tax Exemptions in Maine. For a few statutory exemptions all vehicles registered in the State of Maine are subject to the excise tax. In Maine certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

While the Maine sales tax of 55 applies to most transactions there are certain items that may be exempt from taxation. MAINE REVENUE SERVICES SALESEXCISE TAX DIVISION AFFIDAVIT OF EXEMPTION For purchases of electricity fuel or depreciable machinery or equipment for use in commercial agricultural production commercial fishing commercial aquacultural production or commercial wood harvesting pursuant to Section 2013 of the Maine Sales and Use Tax Law. Desires to register that residents vehicles in this State are hereby exempted from the annual excise tax imposed pursuant to 36 MRSA.

Excise tax is paid at the local town office where the owner of the vehicle resides. WHERE DO I PAY THE EXCISE TAX. Excise tax is defined by Maine law as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways.

A registration fee of 3500 and an agent fee of 600 for new vehicles will also be charged for a total of 64180 due to register your new vehicle. Animal Waste Facility 36 MRS. Veterans Excise Tax Exemption.

Adult Use Marijuana Licensing Ordinance. Excise tax is paid at the local town office. The vehicle must have disabled veteran plates.

Maine Bureau of Veterans Services Central Office 117 State House Station Augusta ME 04333-0117. The excise tax due will be 61080. Sponsored by Representative Heidi Brooks.

434 20 is further amended to read. 692021 - PASSED TO BE ENACTED. An Act To Exempt Certain Disabled Veterans from the Motor Vehicle Excise Tax.

Military Exemption From Vehicle Excise Tax City of Portland is pleased to allow exemptions for annual excise tax on vehicles owned by residents who are serving on active duty in the Armed Forces and who are permanently stationed at a military or naval post station or base outside of the State of Maine or who are deployed for military service for more than 180 days. LD 1193 HP 871 An Act To Exempt Certain Disabled Veterans from the Motor Vehicle Excise Tax. They are also exempt from one title fee and one drivers license renewal fee.

36 MRSA 1483 sub-12 as amended by PL 2009 c. Shoreland Zoning supplemental application. It modifies the exemption for benevolent and charitable institutions by limiting it to only those vehicles owned by such an institution that are used solely for the institutions purposes and primarily for transporting or delivering goods to persons who have been determined to be eligible to receive.

434 20 AMD 2. Maine offers property tax exemptions to wartime Veterans disabled Veterans Surviving Spouses minor Children and. Partially exempt property tax relates to the following categories.

Comprehensive Plan Revised 2005. The Maine Legislature passed a bill that gives 100-disabled veterans exemption from excise tax on one registered vehicle. 653 Veterans Organizations 36 MRS.

Maine Veterans Property Tax Exemption. Be it enacted by the People of the State of Maine as follows. This individual is permanently assigned to the unit and station identified above is on active duty and is not a member of the Guard or Reserves.

Vehicles owned by this State or by political subdivisions of the State. This page discusses various sales tax exemptions in Maine. An owner or lessee who has paid the excise tax in accordance with this section or the property tax for a vehicle is entitled to a credit up to the maximum amount of the tax previously paid in that registration year for any one vehicle toward the tax for any number of vehicles regardless of the number of transfers that may be required of the owner or lessee in that registration year.

This information is courtesy of Larry Grant City of Brewer Maine The same method will be used to calculate the fees to re-register the same vehicle. Home of Record legal address claimed for tax purposes. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to make a tax.

Except for a few statutory exemptions all vehicles registered in the State of Maine are subject to the excise tax. This bill amends the law that allows certain exemptions from the vehicle excise tax. 6551T Veterans Exemption 36 MRS.

207-626-4471 Homeless Veterans Coordinator 207-446-0168 Maine Veterans Memorial Cemetery System 207-287-3481. Homestead Exemption -This program provides a measure of property tax relief for certain individuals that have owned homestead property in Maine for at least 12 months and make the property they occupy on April 1 their permanent residence. The owner of a watercraft located in this State that is not exempt under subsection 4 shall pay an annual excise tax within 10 days of the first operation of the watercraft upon the waters of this State or prior to obtaining a certificate of number pursuant to Title 12 section 13056 or prior to July 1st whichever event first occurs based on the following.

Several examples of exemptions to the sales tax are most. Where do I pay the excise tax. The following are exempt from the excise tax.

Automobiles owned by veterans who are granted free registration of those vehicles by the Secretary of State under. How to use sales tax exemption certificates in Maine.

Maine S Governor Proposes To Replace The Income Tax With A Broader Sales Tax Tax Foundation

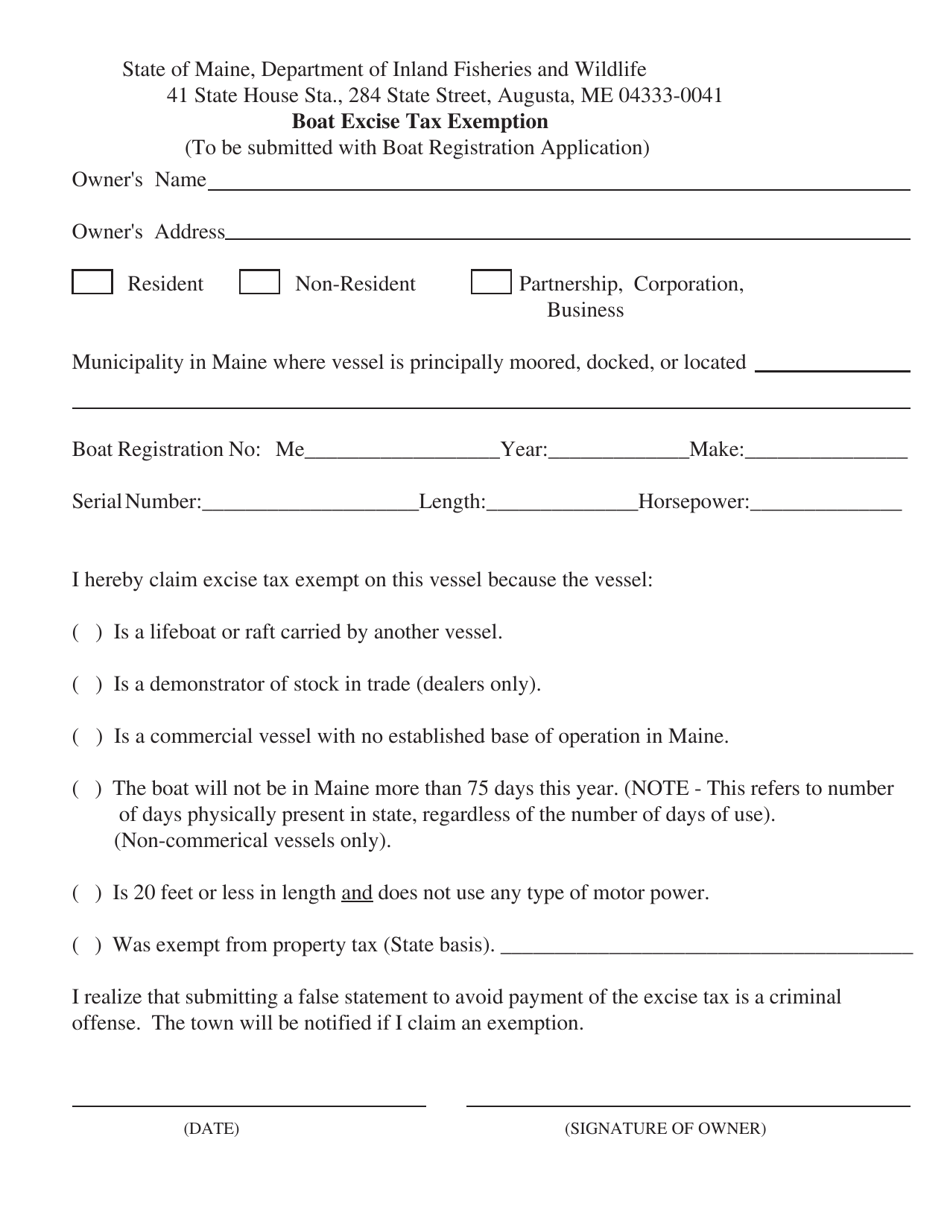

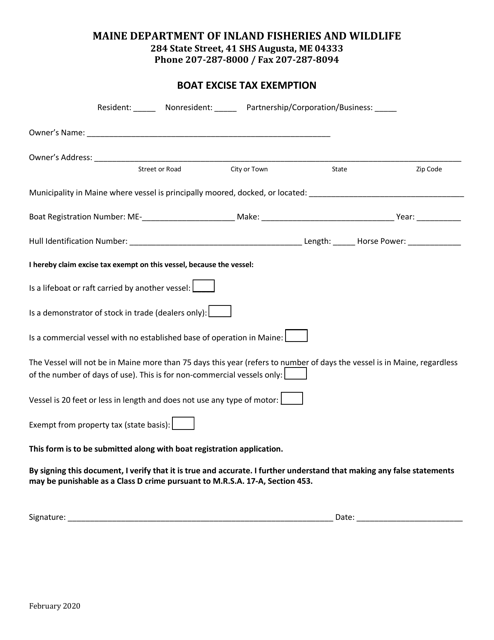

Maine Boat Excise Tax Exemption Download Printable Pdf Templateroller

Vehicle Sales Tax Deduction H R Block

Maine Sales Tax On Cars Everything You Need To Know

Maine Boat Excise Tax Exemption Download Fillable Pdf Templateroller

Ultimate Excise Tax Guide Definition Examples State Vs Federal

M K Gandhi Early Life Freedam Struggle Gandhi Quotes On Education Gandhi Life Gandhi Irwin Pact

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Sales Tax Compliance It S All About Where And What You Sell

What Is Sales Tax A Complete Guide Taxjar

Maine Vehicle Sales Tax Fees Calculator

Ultimate Excise Tax Guide Definition Examples State Vs Federal

Maine Reaches Tax Fairness Milestone Itep

100 Disabled Veterans Are Exempt From One Vehicle Excise Tax Title Fee And Drivers License Renewal Fee Greene Me

Maine Is A Magnet For R I Rigs

These Are The States Whose Residents Pay The Highest Taxes Income Tax Tax Refund Income Tax Return